Just The Facts : Education Corner : Business Basics, Credit Card Processing, ROI (Return On Investment)

Business Basics

A Successful Modern Business

The more efficient & organized, the greater the profit potential

A product without good reporting, isn't a product worth having

There are things to look out for with some of our competitors.

- Some of our competitors track usage in ways that is nothing more than a fallacy and report them as facts

- Some of our competitors also provide misleading information, the truth is hiding in the fine print and will typically raise your rates

There are some basic principals at running a successful, thriving business.

- Profitability = Noticability + Engagement + Respectability

- Retention Rate = (Customers At End of Month - Customers Acquired This Month) / Customers at Start of Month

- 95% of people who enrolled in a mobile loyalty program said they were likely to continue using it.

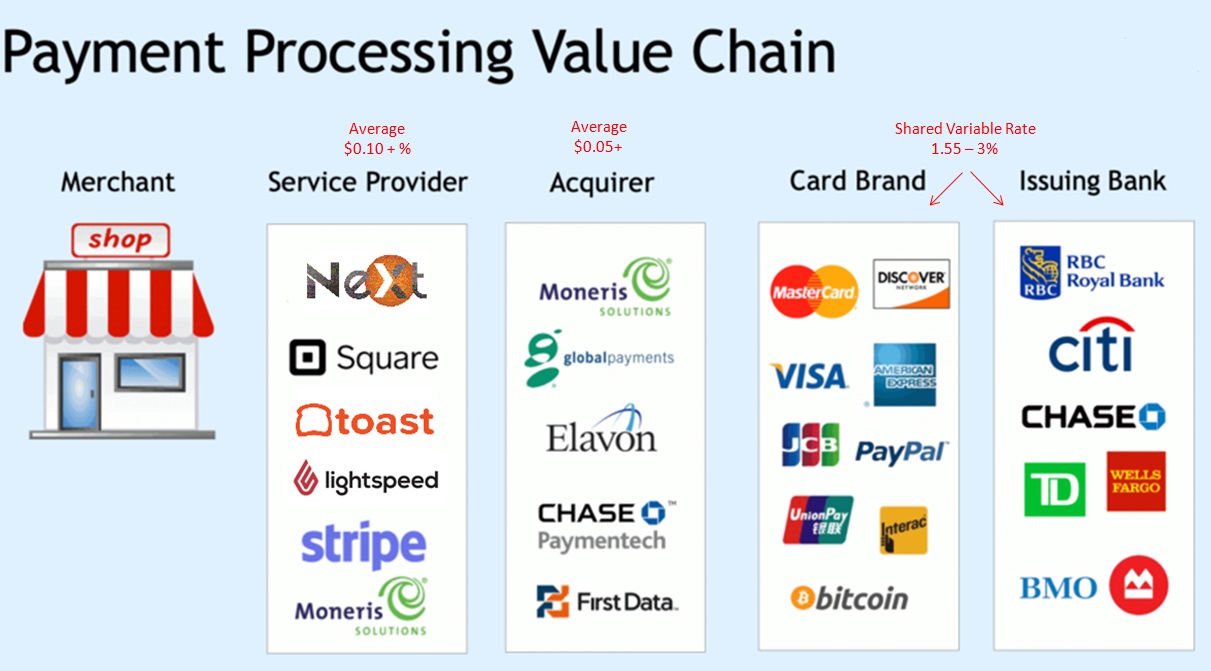

Credit Card Processing : 101

Credit Card Pricing Explained

Credit card charges can be confusing, here are some basic rules.

- Each brand VISA®, Mastercard®, Discover®, and American Express® have their own pricing structure

- Different cards from the same brand can have different, rates. It's usually based on the points offered for the card

- On average credit cards are processed at 2%

- Credit cards are cheaper below $17.00, $17 is our breakeven point between a credit card vs debit card.

-

There are 3 Types of Credit Card processing available

- Interchange Plus : Dollar Amount Plus Basis Points

- Percentage Based : Percentage + Dollar Amount

- Charge Your Customers : Customer Pays Credit Card Fees

- Most Competitors (POS Companies) Choose percentage based, because they make more money that way

- NeXt uses Interchange Plus, and a simple affordable flat fee of $0.10 per authorization

- Majority of the money we make goes right back into research and development to create new products to help businesses like yours

Common Credit Card Pricing Example

When our competitors are offering 2.6% and $0.10 per authorization they are making a lot of money. Example: $100,000 and 3000 credit card transactions in 1 month.

- $100,000 * 2.6% = $2600 : POS Company Charge

- $100,000 * 2.0% = $2000 : Credit Card Company Charge

- 3000 * $0.10 = $300 : Authorization Charge

- Our Competitors Revenue : $300 + ($2600 - $2000) = $900 per month

- $900.00 per month before they charge you for any additional fees, hardware, or software

- Some competitors charge 2.9% and $0.15, Imagine the costs

NeXt pricing is more affordable and easier because we charge $0.10 on our best tier, and we do pass through pricing, you pay only what the credit card company charges.

- $100,000 * 2.0% = $2000 : POS Company Charges

- $100,000 * 2.0% = $2000 : Credit Card Company Charges

- 3000 * $0.10 = $300.00 : Authorization Charges

- NeXt Revenue : $300.00 + ($2000 - $2000) = $300.00 per month

- $300.00 per month before we charge you for any additional fees, hardware, or software

Savings

With NeXt the cost savings is significant $900 vs $300 /month

Which would you rather pay?

Calculate your savings by clicking button below

ROI Crash Course

What is ROI (Return On Investment) ?

ROI (Return On Investment) in simple terms states, based on what you am receiving for what you gave up (Regardless of Financial or Sweat Equity). Essentially you should be getting more than what you put in.

- ROI < 1 : A Loss

- ROI = 1 : Break Even

- ROI > 1 : A Gain

Example:

Lets take a stock market Investment. I put in (Invested) $2.00, then benefits or what I received was $6.00. The ROI = 3. However a number without units is meaningless, so we want it in percentage and we multiple (ROI)3 * 100% = 300%, which is a gain.

Companies Are Showing ROI, How are they doing it?

Companies cannot calculate ROI, mainly because they don't collect enough data. Because they don't collect enough data any ROI they show you, you should be skeptical of. They are generating numbers for you, which are most likely not accurate.

Direct competitors showing ROI (Return On Investment) are showing a manipulated value, that is not your ROI. They make assumptions and use averages that cannot accurately represent a company.

Example

Let's use these averages {2,3,4} = 3, {5,6,7} = 6, {1 ... 30} = 15.5. Now if we just say we are going to use average, the overall average is ({2,6,15} = 24)/3 = 8.

In a worst case scenario let's say for an arbitrary representation of your company ({2,5,1} = 8) / 3 = 2.666.

The numbers above produce a difference by 67%. So when companies use statistical data, they can actually be really wrong about your business. This is why, not every business runs the same.

Yes, the same principals apply in running a business, but there are so many different variables for a business, personally using averages is wreckless and dangerous and we are suprised that

our competitors do so.

Calculating a True ROI needs answers to many variables

- Business Location

- Business Type

- Profit Margins

- Number of Sales

- Price Per Sale

- etc.

Other Factors To Think About!

- When Calculating ROI do you use the loss of product which might have been only $2.00 or Do you use the Loss of Revenue Which that product might sell at $12.00 with a $10.00 profit margin

- Are you going to factor in the cost of energy? Standalone tablets use a lot of more electricity than a barcode reader

Can NeXt Calculate My ROI?

Yes & No! Unfortunately, NeXt cannot directly calculate your ROI. Because no-one other than you can calculate the benefit of the software. However, what we do know is mathematics. Here is what we can tell you. Many of our competitors are more expensive than NeXt. Let's assume one of our competitors roughly charges $300.00 per month ($3600.00 / year). Let's compare NeXt to that competitor to show how NeXt has a better ROI.

Examples are the best way to learn

Let's reuse the equation from before!

- Software works

- Customers are happy

- You are bringing in more customers

- Making more money

- etc...

Given the equation above there are only 2 numbers, we have the top number and it's static. There is only 1 other number that can change in the equation above. The Investment. Remember our competitor charges nearly $3600 / year, NeXt charges roughly $900 / year, these are the controllable costs.

| Competitor | NeXt | |

|---|---|---|

| Benefit | $2000 | $2000 |

| Investment | $3600 | $900 |

| ROI | .55 | 2.22 |

| Percentage | 55% | 222% |

So what does this table say?

- First, it says for this condition a business using our competitor is not gaining enough from the software to offset the cost of the product. Infact the business is taking a 45% loss.

- Finally the table also says, NeXt for this customer given the same conditions is actually seeing a good benefit of 222%, which means there is significant gains in profits.

How does that work? Well assuming that NeXt can do what our competitors can do, then lowering the price you pay for that functionality is very important.